IG Index's Generalities

General Points (we will strive to keep this review up-to-date)

- Account Types: Two types of trading accounts are offered - the Plus Account and the Limited Risk Account. The Plus Account comes with tight dealing spreads and full PureDeal functionality including DealThru Charts, Trailing Stops and one-click dealing for faster execution. The Limited Risk Account comes with guaranteed stops on all trades (so maximum amount you can lose is limited to amount invested) but you will pay a little more spread on each trade for the privilege.

- Deposit Requirements: Initial Account Size can be zero. You can have a credit account with IG (if you show them evidence of sufficient liquid funds) so don't need to have funds on account. Less hassle than having to constantly make margin payments. An administration fee of 1.50% of the amount deposited applies for credit card deposits (as this carries a cost to IG) - note payments made using debit cards are free of charge.

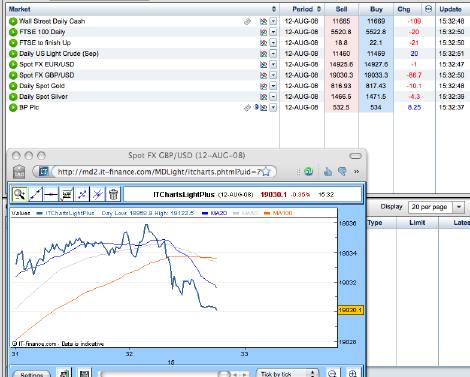

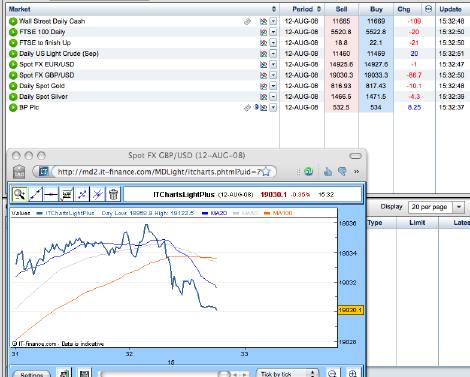

- Customization: The IG Index Platform is simple to use and very easy to configure. It allows you to build up a watchlist of the markets you wish to bet on. The watchlist shows you the real time prices being offered for buy, sell +/- on day...etc. Sometimes the price may not exactly match the underlying market, although in my experience IG are always pretty close. If you use quarterly bets the prices drift further away from the daily price as the spread increases to incorporate a financing charge. The additional spread or charge that IG adds to any trade is shown when you click on the deal button in the watchlist.

- Accessibility: Finding your market on PureDeal is very easy/fast using the PureDeal search feature.

- Fees: There is an inactivity fee on accounts if no dealing activity happens for two years or more. The fee is £12 on the first of every month.

- Rollovers: The daily rollover time is 8pm UK time, 2 hours earlier than most other firms. To check market opening times, one logged in, click on the down arrow which is on the right of the trade, and go down to 'Get Info'. This will display the market opening and closing times.

- Stops: Stop and limit orders are now based on the bid or offer of IG Index's quotes (as opposed to the market price as they were in the past...).

|

IG Index PureDeal Platform.

- Mobile Trading: IG Index's trading platform covers both Android and Apple devices, including the iPad, and also supports Blackberry and the Windows 7 phones. These include all the options available on the web platform including the functionality to place stops, limits and working orders as well as the ability to check charts in a variety of timeframes and add indicators as required.

- Unusual Markets: Currently you can spread bet on the average house price in Greater London and the UK. IG Index offers prices just two quarters ahead, compared with four originally, reason being that it is harder for IG to make a price for longer periods and they are not able to hedge the underlying risk. Another novelty market is the carbon market which measures carbon emissions and started trading as a result of the Kyoto Protocol in which signatory countries agreed to specific targets for cutting environmentally harmful emissions. The market is quoted 7am to 5pm with £2 a point being the minimum bet and margin being 150 times the stake. It is notable that carbon credits are directly related to the price of oil - as this increases companies will switch to cheaper (more polluting) alternatives and buy in the extra carbon credits.

- Particularities: IG Index have a unique feature allowing you to open multiple positions in different directions within the same market as long as you tick the so called 'Force Open' function on any new deal ticket that might affect an existing position. For instance IG will allow you to open a March short and a Sept long in the same instrument (CMC do not allow this). You can also do the same for a position which is the same. For instance you could place £5 a point going long in a March contract and £5 a point going short in a March position. To do this, you will have to make sure the 'force open' button is selected on the deal ticket.

- Multilateral Trading Facilities: IG Index has also moved to incorporate a number of alternative execution venues or Multilateral Trading Facilities (MTFs) like Turquoise, BATs and Chi-X Europe into its trading platform as opposed to just the London Stock Exchange for the pricing of shares spread bets. This means that clients are not dependent on a single exchange for prices. This also means greater liquidity for IG's clients and tighter spreads since they receive a more transparent service with the best possible prices. With up to 40% of shares now typically being traded away from the LSE, ensuring clients can also use prices from the likes of Chi-X and BATS Europe means that, in the vast majority of cases a more competitive trade can be delivered. This process is entirely seamless for spreadbets as the technology works behind the scenes to search out better prices and clients are presented with the best quote from all the underlying liquidity venues, with the firm simply adding a fixed mark-up to the bid-offer spread.

- Binary Bets: They offer binary bets which are included as part of IG's 'Trading Volatility' product offering. These are starting to be offered by more spread betting firms now, but IG Index still have a very good range. These are basically bets which can either be right or wrong, e.g. FTSE 100 will be up on the day - this either happens, in which case you win a fixed amount of money, or it goes down, in which case you lose your stake. It's based upon the use of options, but made much more user-friendly. In addition to binaries, the firm offers daily options that again offer a fixed risk way of playing the volatility in a wide range of markets. Try them if you want, but it's more like betting to me than investing.

- Education: There is an online spread betting guide which explains what spread trading is about, how it works and ways to manage the risks. A few years ago also launched the TradeSense six-week training package for those new to spread betting which reduces dealing sizes for new clients. The training package comes with 6 modules about the most important aspects of trading including: stop orders and risk management, leverage, margin, attitude to risk, stock markets and trading discipline. In the first 2 weeks of the TradeSense programme, clients can trade at 50% of the minimum bet sizes to allow themselves time to familiarise themselves with the markets and platform. After this two-week period the bet sizes are adjusted to standard minimum bet sizes and traders are expected to pay the minimum £1 a point for their deals.

- Seminars: IG Index host some 15 one-hour webinars (online seminars) every month as well as two-hour real-life seminars presented by David Jones, the company's chief market strategist. There is also an office based presentation almost every week as well as regional seminars held in Bristol, Birmingham, Edinburgh, Leeds and Manchester.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.